Ghassan Moazzin is an assistant professor in the School of Humanities and the Hong Kong Institute for the Humanities and Social Sciences at the University of Hong Kong. His first monograph, Foreign Banks and Global Finance in Modern China: Banking on the Chinese Frontier, 1870-1919, was published by Cambridge University Press in 2022. He now works on the history of the electrical and electronics industries in modern China.

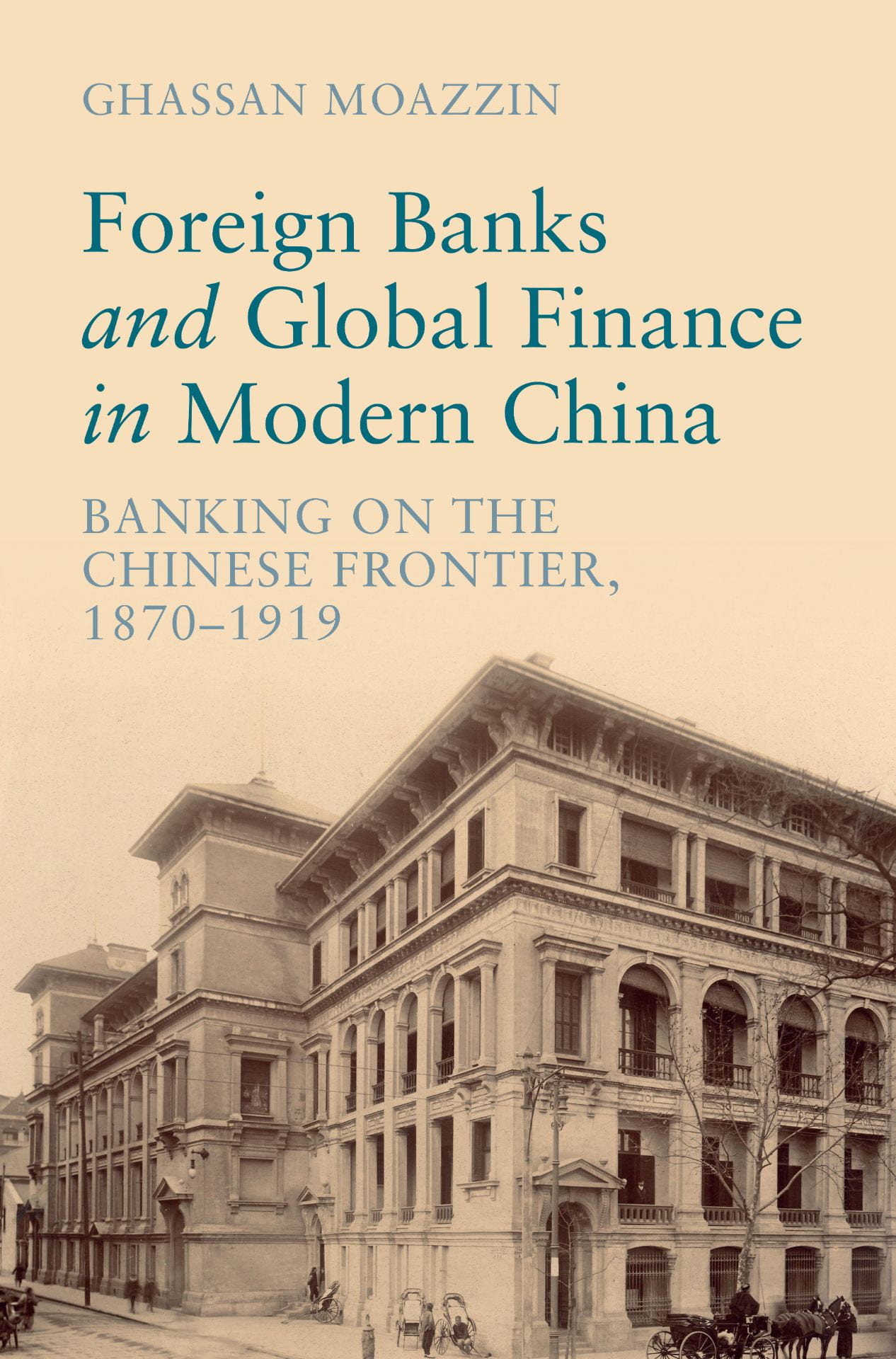

Fig 1: Hankow Road (Hankou lu) photographed from the Bund. On the left: The Custom House. On the right: The German-Asiatic Bank

© 2012 Billie Love Historical Collection, BL02-024

Figure 1 shows the Bund in May 1911. On the right-hand side, we see the Shanghai branch of the Deutsch-Asiatische Bank (DAB) situated next to the building of the Chinese Maritime Customs Service. While few know of this bank today, it was a leading player amongst foreign banks in China at the turn of the twentieth century and the main case study I focus on in my recent book Foreign Banks and Global Finance in Modern China. My book explores the history of foreign banking in late nineteenth and early twentieth century China.

Foreign banks entered China shortly after the end of the First Opium War. The first foreign bank that opened its doors in China was the Oriental Bank, which we can see in this picture from around 1870 tucked away behind some trees at the Bund. At first, foreign banking in China remained a largely British affair. However, starting from the 1890s, foreign banking became much more diverse with banks originating in many other countries also entering the scene. Apart from the DAB, which began business in Shanghai in 1890, another example of a new non-British bank that entered China after 1890 was the Japanese Bank of Taiwan.

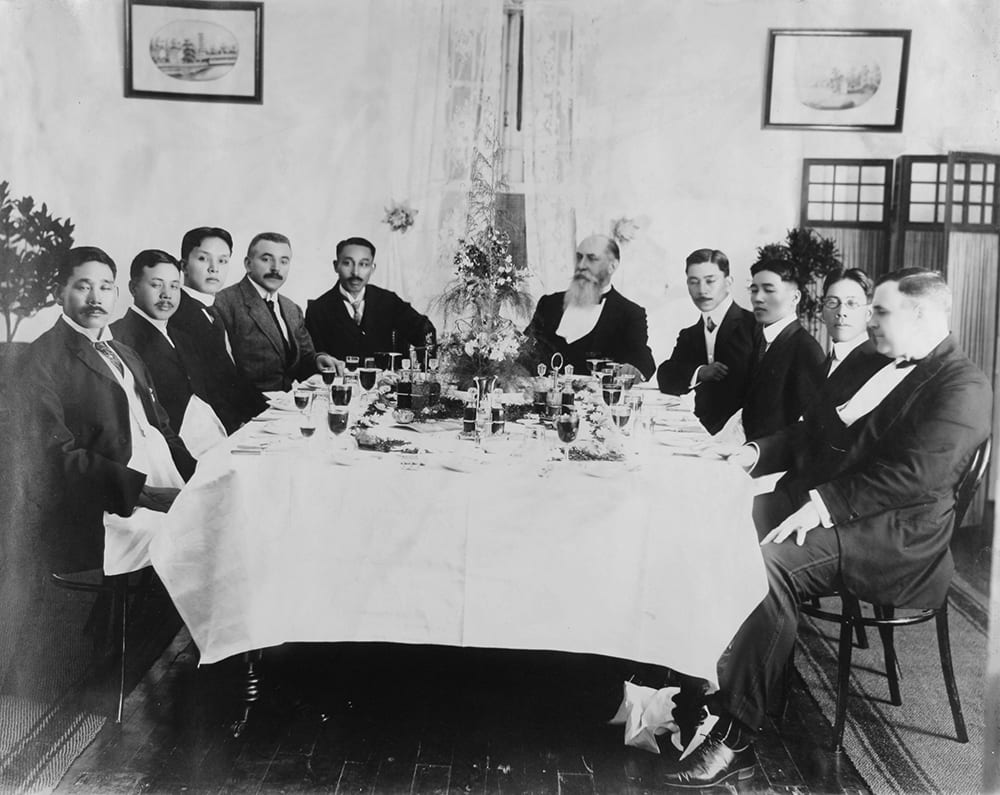

Fig 3: Farewell dinner given by Manager of Bank of Taiwan, Swatow, 1913 Reginald Hedgeland Collection He03-022 © 2007 SOAS

Foreign banks could be found not only in Shanghai but also in other treaty ports. They became involved in a range of activities, including trade finance and the raising of capital on bond markets abroad for the Chinese government. In the Chinese banking sector, foreign banks interacted with Chinese bankers. At the same time, their representatives also came into contact with Chinese government officials during loan negotiations.[1]

In terms of the DAB, my book traces the fortunes of the bank from its establishment in 1889 and its beginnings in China in the 1890s through to its liquidation by the Chinese authorities during World War I following China’s siding with the Allies and declaration of war against Germany. I describe the early interactions of German bankers leading up to the DAB’s establishment; how the bank operated in the Chinese banking sector after 1890; how it became involved in the large loans China used to fund the repayment of the Japanese indemnity imposed after the Sino-Japanese War; what role German bankers played in the funding of the development of Chinese railways; how German and other foreign bankers and China’s international financial connections shaped the 1911 revolution and the triumph of Yuan Shikai; and how the DAB tried but eventually failed to use financial means to persuade China to maintain its neutrality in the First World War.

Fig 5: Yuan Shikai (袁世凯), the first President of the Republic of China, Beijing, 10 October 1913 William Cooper Collection WC01-197 © 2016 Historical Photographs of China

More broadly, Foreign Banks and Global Finance in Modern China shows that foreign banks need to be seen as important intermediary institutions that aided China’s financial linking with the global economy. At the same time, my book highlights how important Chinese agency and cooperation with Chinese actors were for foreign banks.

[1] One such representative featured in my descriptions of loan negotiations with Chinese government officials in the book is the HSBC’s Edward Guy Hillier, who readers of this blog will be familiar with from two posts, here and here, by HPC Research Associate Dr. Andrew Hillier.